PAYROLL AND TAXES

Employers of non-US citizens must follow procedures delineated by the IRS regarding withholding taxes from their wages. Non-US citizens include both “resident aliens” and “nonresident aliens”. The participants on the CIEE Work & Travel USA program will be “nonresidents” for US tax purposes. They will be subject to the special withholding rules and rates described below.

HOW TO COMPLETE A W-4 FORM FOR YOUR CIEE WORK & TRAVEL USA PARTICIPANTS

The IRS provides the following instructions:

Quick facts

The federal tax code requires that J-1 exchange visitors be treated as follows:

Here is an example:

HOW TO COMPLETE A W-4 FORM FOR YOUR CIEE WORK & TRAVEL USA PARTICIPANTS

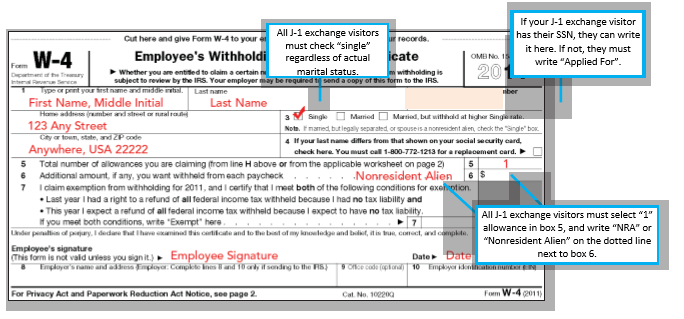

The IRS provides the following instructions:

- Enter a social security number on Line 2. An ITIN is not sufficient. You may write “Applied For” if the participant did not yet receive an SSN. Check only “Single” marital status on line 3, regardless of actual marital status

- Do not use the Personal Allowances Worksheet at the top of the W-4—with very few exceptions, this is for U.S. residents only

- Claim only one withholding allowance (enter “1” on line 5)

- Write “Nonresident Alien” or “NRA” above the dotted line on line 6 of Form W-4

Quick facts

The federal tax code requires that J-1 exchange visitors be treated as follows:

- J-1 exchange visitors must pay: Federal income taxes, state income taxes, local income taxes

- J-1 exchange visitors do not pay: Social Security taxes, Medicare taxes, federal unemployment taxes

Here is an example:

What if I have been withholding FICA/FUTA from my J-1 exchange visitor’s paychecks?

You should change the employee’s withholdings for future paychecks, and issue them a refund of the total amount withheld in error. You can claim a refund of incorrectly paid FICA/FUTA taxes when filing your employer’s federal tax return. (See instructions for IRS forms 941 and/or 944 for more information.)

CALCULATING FEDERAL WITHHOLDINGS FOR YOUR J-1 EXCHANGE VISITORS

The following information may be useful to whomever is responsible for processing your payroll. It was gathered from www.irs.gov/ and is applicable to the tax year 2019. Tax withholding instructions change every year, and major revisions have been announced for 2020. Host employers should be sure to check that they have the latest information and work with their own payroll provider or tax expert to confirm exchange visitor’s payroll. The IRS provides annual instructions to employers in Publication 15, Circular E, which is available at www.irs.gov/businesses.

Host employers must follow a special procedure for calculating the amount of federal income tax to withhold from the wages of their J-1 exchange visitors. Employers must add an amount to the participant’s wages before calculating how much tax to withhold. This extra amount is solely for calculating the withholding Federal income tax--, it does not increase the employee’s tax liability, and should not be included on their W-2 form. The sole reason for this gross up is to make sure nonresident aliens are sufficiently paid in, given that they are not able to take the standardized deduction that is available to residents.

You should change the employee’s withholdings for future paychecks, and issue them a refund of the total amount withheld in error. You can claim a refund of incorrectly paid FICA/FUTA taxes when filing your employer’s federal tax return. (See instructions for IRS forms 941 and/or 944 for more information.)

CALCULATING FEDERAL WITHHOLDINGS FOR YOUR J-1 EXCHANGE VISITORS

The following information may be useful to whomever is responsible for processing your payroll. It was gathered from www.irs.gov/ and is applicable to the tax year 2019. Tax withholding instructions change every year, and major revisions have been announced for 2020. Host employers should be sure to check that they have the latest information and work with their own payroll provider or tax expert to confirm exchange visitor’s payroll. The IRS provides annual instructions to employers in Publication 15, Circular E, which is available at www.irs.gov/businesses.

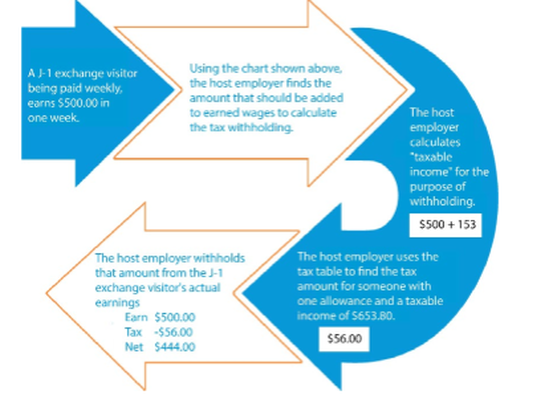

Host employers must follow a special procedure for calculating the amount of federal income tax to withhold from the wages of their J-1 exchange visitors. Employers must add an amount to the participant’s wages before calculating how much tax to withhold. This extra amount is solely for calculating the withholding Federal income tax--, it does not increase the employee’s tax liability, and should not be included on their W-2 form. The sole reason for this gross up is to make sure nonresident aliens are sufficiently paid in, given that they are not able to take the standardized deduction that is available to residents.

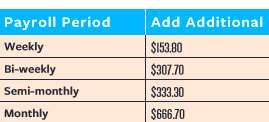

The additional amount to withhold depends on the frequency of your payroll, as shown in the chart above.

Employers may use the “percentage” or “wage bracket” method to calculate withholdings. The example flowchart below is for employers who use the “wage bracket” method for calculating withholdings. If you use the “percentage” method, CIEE recommends you consult the IRS or a tax professional to ensure that you withhold the correct amounts. Explanations of both methods can be found in Publication 15.

**Please consult your payroll provider or tax expert to confirm payroll and tax withholdings for your participants.